2025 TOWN OF CAIRO NOTICE OF COMPLETION OF FINAL ASSESSMENT ROLL filed July 1st, 2025

ASSESSOR: Janice Hull

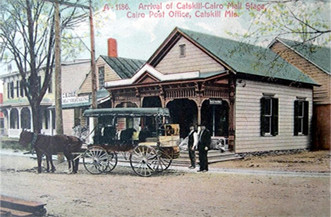

PO Box 132, 512 Main Street

Cairo NY 12413

Phone: 518-622-3120 ext 252

Email: [email protected]

OFFICE HOURS:

| Mon – Fri: | 9AM – 3PM |

| CLOSED HOLIDAYS |

NOTICE: Office Staff (identified by Town of Cairo photo ID) are out in the field throughout the year to take photos, to collect/recollect or to review real property data inventory to maintain accurate property records

***PLEASE NOTE***

MARCH 1st of each year is taxable status date DEADLINE for applying for property exemptions: veterans, agricultural, non-profit, low income senior citizen &/or low income disability, solar, business, forest and renewal exemptions

- Download an application go to:

- tax.ny.gov or click link NYS Taxation & Finance

QUALIFICATIONS for SENIOR CITIZEN EXEMPTION:

- Must be 65 years old

- Must be your primary residence

- Must meet GROSS income requirement of $45399.99 or lower (NOT AGI – Adjusted Gross Income) for 2024 income tax year

- Must submit by March 1st 2026 deadline:

- RP467 application completed/signed to assessor’s office along with driver(s) license(s) & both 2024 Federal AND 2024 NYS returns and requires filing yearly renewals

- DOWNLOAD RP-467

Copy of your TAX BILL:

- Go to: townofcairony.gov

- Click: Departments

- Click: Tax Collector

- Access property &/or school tax bills on-line

- Click: link for property bill

- Click: link for school bill

CHANGE OF ADDRESS:

Click Important Links: Change of Address Form

**Please include tax map number(s) and property street number and street name and contact phone/email info